Our Work

Working toward a more sustainable OMERS Pension Plan

MEPCO knows that municipal employers continue to support the OMERS defined benefit pension plan. Municipal employers believe that the OMERS Plan must be sustainable and affordable for both employers and employees and continue to provide meaningful retirement benefits.

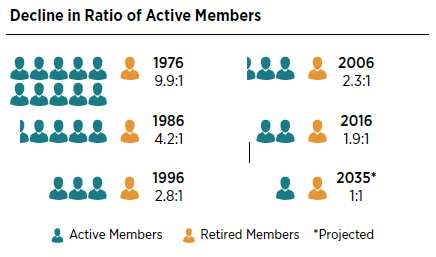

The OMERS Plan – like many peer pension plans – has matured, meaning there are almost as many retired members receiving pensions as there are active members who are making contributions. Investment returns help the Plan assets to grow, but factors such as inflation, global conflict, and climate change will continue to impact markets.

AMO and MEPCO believe it is responsible for OMERS to review the risks and challenges to meeting its goal of a sustainable, affordable, and meaningful defined benefit pension plan. Carefully considering the risks enables OMERS to have the right strategies in place to be successful in fulfilling its pension promise for current and future plan members.

The Plan Faces Challenges

Plan Maturity

There are now fewer active members to support a growing group of retirees.

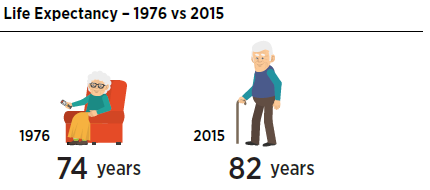

Demographic Changes and Longevity

People are living longer, so they spend more years retired. The Plan will have higher liabilities and higher pension costs as it pays out pensions for longer periods of time.

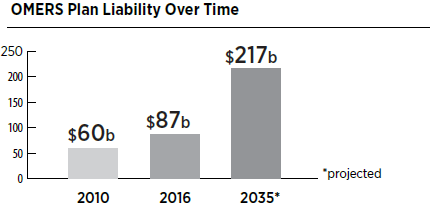

A Changing Workforce

OMERS active membership is likely to shrink over the next 25 years as factors such as technology, privatization and other forces impact employment trends. As the Plan matures, its liability grows. The Plan will face a $300 billion liability based on current projected costs.